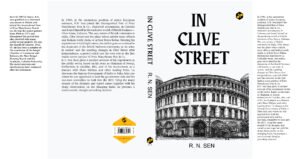

The book written by RN Sen, “In Clive Street,” has been reprinted.

“In Clive Street,” has been reprinted.

THAT WHICH CANNOT BE COUNTED

Roopen Roy

“Not everything that can be

counted counts, and not everything

that counts can be counted.”

—Albert Einstein

At the time it made a decision to diversify into Information

Technology, the firm was a conservative partnership

of chartered accountants. It was well-known for its

audit, accounting, tax services and an offering of “non-

IT”consulting services. The decision to set up an IT

practice was, not surprisingly, made after some intense

debate. Some partners felt that it would be better to stick

to the knitting. Some felt it would be foolish to stray

into uncharted waters. It was more an apprehension and

trepidation for the unknown rather than a desire to defend

the status quo.

With the wisdom of hindsight, I would submit that

had it not been for the vision and leadership of the senior

partner Kamesh Prasad Bhargava a.k.a. K.P.B., the project

would not have seen the light of the day. A number of

decisions were taken under his leadership which may

seem intuitive and easy today. But they were tough and

courageous decisions at the time. We had to break away

from traditions. From entrenched culture and mindset.

First, it was decided to use a shell company called Price

Waterhouse Associates (P) Ltd. to house the proposed IT

practice. The limited liability nature of this entity appealed

to the partners who were not certain of the success of this

venture. What was designed primarily to firewall the core

business from uncertainty and risks, turned out to be a

great positive for the fledgling practice.

The sole purpose of housing the practice in a corporate

entity, however, was not to avail of the advantages of limited

liability. It had several distinct business advantages: a) as

it was not a chartered accountants’ partnership, it could

admit non-chartered accountants to the highest echelons

of leadership. This was a fundamental requirement if we

were to attract high performing engineers, MBAs and

computer scientists to our fold, b) we were not bound by

the limitations of the audit profession and could compete

freely, c) we could pay compensations that were driven

by the market and not stymied by debates of “uniformity”

within the same “group”, and d) we could hire a CEO who

might have to be paid more than several partners, even

perhaps the senior partners.

There was yet another reason which was kept lowkey.

It was my belief that a new practice like IT needed a new,

scrappy start up environment to flourish. In fact I argued

and succeeded in convincing the senior partner that we

needed to operate in a different physical location away

from the watchful eyes of a doting parent.

When the first rudimentary business plan was written

on a twin floppy Wipro PC which was sold to me by Sudip

Bandyopadhyay (a stalwart in Wipro now) and printed on

a dot matrix printer at my home, IT company was about to

be born. Dick Wheaton who had just relinquished Global

MCS leadership to a Canadian partner Dick Mineau

appeared on the scene. He had assumed an Asia Pacific management role that included oversight of the Indian practice.

He suggested that he provide help in interviewing the potential candidates for CEO and assigned Ran Advani, then a MCS partner in the New York practice to come out and help. He also mandated that an Indian partner should be dedicated to the IT practice.

It was at this time that a debate began as to where we should locate the IT practice—in Calcutta or in Delhi. The MCS leader at that time was Amal Ganguli. It was his belief that the practice should be located in Delhi. It was my belief, and I was then a fairly junior partner, that it should be located in Calcutta. There were a number of reasons why I differed with him. My clinching argument that resonated with the leadership was: the start-up must incubate peacefully with the senior partner providing it with nourishment, protection and support until it was able to stand on its own two feet. I still remember the afternoon we were all gathered in the Burma-teak paneled “board” room in Gillander House that changed the trajectory of my career and my life. After debating like true gentlemen, we had a show of hands and it was decided that the IT practice will begin initially in Calcutta under my leadership. I was directed to convert it into an all-India practice under the overall direction of K.P.B. I still remember what K.P.B. said, suppressing with great difficulty all the affection he had for me, “Gentlemen, the young man will now have to swim or sink with the new company.”

The second step was even more difficult to take. I requested that I should report to K.P.B. directly. In those days this was heresy. The MCS leader was Amal Ganguli. The MCS leader in Calcutta was Subhra Jyoti Dutt (fondly called S.J.D. by his numerous followers that included me) S.J.D. had an enormous affection for me. There were two

other senior partners in MCS—Atin Chaudhury under

whom I had served as an articled clerk and Amarnath

Sadhu. Amar Da was a delightful gentleman whose mind

was a well spring of the most novel ideas and lateral

thoughts. My request meant that I would bypass them

in a reporting sense. K.P.B. had a lot of push back but I

know the organization chart then had to live with strategic

ambiguity. I continued to report directly to K.P.B. and was

not sure what the Org Chart would say if it had to be

printed.

We were scouting for a 2500 sq. ft. flat and had looked

at several properties in South Calcutta. On one of his

morning walks K.P.B. heard that a flat belonging to the

nuclear scientist Dr. Bikash Sinha was available for lease. It

was not fully built up then. We went to the site pompously

called Sukh Sagar (The Ocean of Happiness). It was a multistoryed

building under construction. We liked it and liked

the rent even better. The deal was sealed in no time. Now

that we had a “brick and mortar” home for the practice, it

was time to look for a practice leader.

We advertised in the Press and Ranjit (Ran) Advani flew

in from New York to assist us with the recruitment. There

were three shortlisted candidates—all from established

MNCs—ICI, ITC and Dunlop. We liked the candidate

from Dunlop the best. He was an Electrical Engineer from

Jadavpur University who had joined IBM in hardware

maintenance. When IBM installed its first 1401 in Dunlop

he was located by IBM at the customer site in Sahagunge.

And when in 1977 IBM withdrew from India following a

spat with Minister George Fernandes, he was absorbed by

Dunlop.

At the time he applied for the position in Price

Waterhouse Associates Private Ltd. (PWAPL) he was

incharge of computer applications in Dunlop and

inaddition he looked after some commercial activities

like procurement in Dunlop. Dunlop had changed hands and the RPG group had taken over the management. He wanted to switch over and was excited about our start up venture. We found him to be most enthusiastic among the three shortlisted candidates. We offered him the position. His name was Arnab Bhattacharya.

The capital structure of the fledgling company was interesting. The partners of the Indian firm contributing a total of Rs.1 lakh (Rs.1,00,000 only) in equity. The world firm guaranteed an overdraft of upto Rs.20 lacs as overdraft with Citibank.

Now that we had a company, a physical home and a practice leader we needed some business and clients. While Arnab was serving notice with Dunlop, two significant events happened. Our audit partner Tapas Ray was ill one day and I was asked to stand in for him at the Indian Aluminium (an Alcan subsidiary) at the AGM. At lunch, I was seated with Tapan Mitra, then the CFO of the company and Mr. Black, the Asia Pac Group CFO from Hong Kong. At lunch I told them about the new venture. Tapan Da said that they were trying to computerize their financial accounting system. But their attempts to do so with M.N. Dastur and TCS had failed because the consultants were unable to comprehend the intricacies of their complex costing and metal accounting system system. Tapanda knew that my team and I were intimately familiar with their accounting system. I finally popped the question over dessert whether they would give us an opportunity. Tapan Da said that we were fully conversant with their requirements and he would not mind giving us a shot. I typed the proposal on my now famous Wipro twin floppy PC and we landed the job. Next week Rathin Da organized a meeting with Bhaskar Rao Chaudhuri of CESC who as an act of faith awarded us the assignment of computerizing the payroll of some 13,000 workmen.

I went into K.P.B.’s room one morning and delivered

the good news and the bad news. The good news was that

we had bagged two substantial assignments. The bad news

was that Arnab was still serving notice and we did not

have the resources to deliver. K.P.B. was visibly worried

and he reminded me that bad news travels fast. We

hurriedly recruited N. Pillai, a programmer, and Rumee

Roy, an MBA from ISWBM. We also recruited Subhendu

Goswami, Abhijit Mitra and Shishir Dandapat—all from

Dunlop and began the assignments. Arnab Da joined us in

due course and we flagged off our IT practice.

Both projects were completed to the satisfaction of the

clients and we began to win new projects and expand our

team. In 1989, in quick succession Jaydeep Mukherjee,

Vivek Halder, Anjan Majumdar joined from CMC and

Ambarish Dasgupta from Bata. We recruited Joydeep

Datta Gupta from a start-up software outfit and Jaideep

Ganguli as well. Amitabh Ray and Shovon Mukherjee

followed. We went to the ISWBM campus and hired half a

dozen MBAs with IT specialization. Later Partha Bardhan

joined followed by Rajarshi Sengupta who was working

with our US firm.

Meanwhile Dick Wheaton took me to the US to meet

the MCS leader of US, Tom Beyer.

Tom had never been to India and he looked at me with

great suspicion. He was, however, willing to try us out.

Over dinner with Tom Beyer and Woody Brittain, we

struck our first staff augmentation contract at Santa Fe

Railways. The project site was in Topeka, Kansas where

a team of Indians led by Anjan and Subhendu Datta were

sent to work on a large project.

IT was catching on in India. Arnab Da received an offer

from GKW where we were working on a project. GKW

wanted to set up an IT company and the CEO of GKW,

Mr. Batra, offered Arnab Da the job of the CEO of their IT

company. In those days GKW was a blue chip company and Arnab Da left suddenly.

The company was faced with a twin crises. It was losing money hand over fist and the practice leader left with two key executives. We were on the brink of disaster. One morning towards the end of the month, I discovered that we were overdrawn to the hilt and did not have enough cash to pay salaries.

That was the closest that we had ever come to catastrophe. We had our back against the wall and the possibility of sinking was real. The chances of swimming was bleak. That was my baptism by fire on cash flow management. Thereafter, I have never neglected cash flows.

I confided in Bhaskar Ray Chaudhuri of CESC about our predicament and appealed to him to provide an undeserved advance of Rs.2 lakhs against work done in CESC. He was understanding and he agreed to provide the money to enable us to tide over the crisis. I took complete charge of cash management and signed every single cheque in the next one year.

The US secondments accelerated and the dark clouds were blown away.

It was a tribute to the young team which worked very hard with me to tide over the crisis.

We transitioned our custom software practice and thanks to a chance opportunity with Bill Niergarth in Philadelphia we sent forty engineers to the US headed by a cranky PhD to help create a CBT system for SAP R/3.

Thereafter, we never looked back. We became the largest implementer of ERP systems in India.

In 2002 October, we had to divest a large part of our MCS practice. I was vacationing with my family in Interlaken in Switzerland. I had to interrupt the vacation and I took a train with my family to Zurich. The final deal of divestment was sealed there.

Kotak, an affiliate of Goldman Sachs had valued our

business between $105 million to $130 million. A business

which started with Rs.1 lakh had grown in value. Our

rainmakers made sure that the rain was falling. We

parted with our friends, our partners, our colleagues and

our comrades. It was a painful day for me and those who

stayed back with the firm and it was painful for those who

went with IBM.

It was the beginning of a new journey for us who

stayed back and those who took a new road. But we were

determined to succeed in our new careers and in the

journey to our new destinations. Tagore had said that the

past is never lost, the bright stars of the dark night always

remain in the depths of daylight.